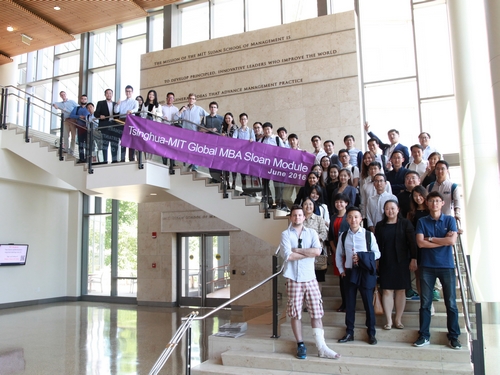

Text by Tim HESLER, GMBA Class of 2017; Photo by Xiangsheng YANG, GMBA Class of 2017

In late June, the Tsinghua-MIT Global MBA

Class of 2017 had the opportunity to experience MBA life across the Pond. In

the wake of the semester’s conclusion, approximately half of the GMBA class trekked

to Cambridge, Massachusetts to participate in an elective module at MIT Sloan

School of Management. Joining the first-year students were two distinguished

SEM alumni as well as Tsinghua SEM Associate Dean and Professor

QIAN Xiaojun, Senior Manager of Global Collaboration and Admissions Doris

XUN, and Corporate Relations Director Fany CHEN. As Tsinghua SEM and MIT Sloan marked

20 years of a tightly knit relationship, four of MIT Sloan’s top faculty and

several other members of the broader Sloan community challenged the thinking of

the GMBA cohort along a variety of dimensions, with a particular emphasis on

innovation and entrepreneurship.

During the first two days of the course, Professor

John Akula facilitated a discussion of key legal frameworks essential to

the aspiring entrepreneur’s tool kit. Himself a practicing attorney of many

years, Professor Akula injected a particularly practice-based legal perspective

into classroom dialogue. Professor Akula walked the cohort through a variety of

frequently litigated corporate contractual provisions and their implications as

construed by courts in various U.S. jurisdictions. Meanwhile, he also solicited

cohort expertise for comparative purposes between judicial interpretations in

China and those in the U.S. Ultimately, he brought those observations to bear

in the context of early-stage agreements with corporate partners and new employees

– both extremely salient for startups, especially those planning to predicate

their ventures on the cross-border marketplace.

After laying a foundation of legal

analysis, the cohort continued to expand its view of entrepreneurship as a process

with the insight of Professor

Bill Aulet, author of Disciplined

Entrepreneurship: 24 Steps to a Successful Startup. Perhaps one of

Professor Aulet’s most striking points was the implication behind an economic

downturn constituting a statistically good time to start a new venture. As

Professor Aulet suggested, a downturn creates an ideal season for pulling in

relatively inexpensive but capable labor while developing “frugal corporate

muscles.” Once those frugal muscles are built, if coupled with an otherwise well-constructed

corporate culture, then even as the economy recovers, much of the existing

labor force will often remain loyal without forcing a company to abandon those

frugal muscles that have built the company’s success. Retaining a lean

operational orientation, Professor Aulet noted, can be critical not only to

survival in downturns but also to fully thriving even in more forgiving

economic seasons.

Professor

Nelson Repenning, meanwhile, offered an introduction to dynamic work

design, considering response mechanisms when things don’t go as planned – as is

often the case in a startup context. Professor

Repenning offered a layman’s overview of a body of neuroscience research that

has distinguished two processing modes of the brain – conscious and automatic –

and suggests that humans tend to save their conscious processing capacity,

which is limited, and offload as much responsibility as possible to automatic

processing.

In the context of dynamic work design,

Professor Repenning suggested that work done by humans, no matter how

automated, is still a fundamentally human activity. Thus, he put forward four

principles for dynamic work design: (1) reconciling action with intent, for

example with pattern matching; (2) structured problem solving; (3) using

optimal challenges with reasonable targets (How much gap between activity and

intent can we successfully manage, and is there sufficient time to tackle gaps

when people fall short?); and (4) connecting the human chain. As one simple

application of the final principle of connecting the human chain, Professor

Repenning suggested that in well-designed work, people know and have regular

contact with those who supply the inputs to their work as well as those who

receive the outputs.

As Professor

Jake Cohen opened the morning of the module’s final class on Friday the

24th, he temporarily dispensed with the scheduled M&A case discussion in

order to address a global development of emerging import. Just a few hours

prior, the UK’s decision by popular vote to withdraw from the European Union

had become official as the votes were tallied. Professor Cohen explored the

potential ramifications of “Brexit” alongside the class, offering not only

answers but also open-ended, thought-provoking questions on the future of

European and global commerce.

The cohort also welcomed a variety of guest

speakers throughout the module and in turn conducted several local site visits.

Professor Akula introduced a variety of MIT alumni, including Wan Li Zhu, a

leading figure in the Boston angel investing community. Wan Li graciously offered

two solid hours of insight into angel financing and witty exchange with

students. Panel discussions with players from MIT spinoffs Woobo and XtalPi offered unique angles into technology commercialization. Finally, the cohort

was also treated to site visits at: (1) 11-year-old Carbonite, a cloud-based data

backup and security company; (2) the Martin

Trust Center for MIT Entrepreneurship, complete with its full range of resources

for MIT affiliates across a spectrum of stages; and (3) CIC

Cambridge, an entrepreneurially oriented workspace that offers the

advantage of being home to more startups than anywhere else on the planet.

As the cohort engaged with MIT faculty,

staff, and the greater institutional community over the course of the module, students

grew in their appreciation for SEM’s long-standing relationship with our sister

school in the Tsinghua-MIT Global MBA partnership. The module’s heavy emphasis,

even in its classroom components, on moving beyond theory to application and

stepping outside the traditional confines of academia, was refreshing and inspiring.

Ultimately, the module served as both an apropos capstone to a year of

integrated MBA study and an optimal pivot point for students returning to

Beijing for a second year of increasingly focused immersion in China’s own

hotbed of innovation.